Today is Tax Day in the United Sates.

Like many other supposedly gender neutral policies, the U.S. tax code has disproportionate impacts on people depending on their gender, many of which are more of a feature of the system as it was intended rather than a bug.

Departed Supreme Court Justice Ruth Bader Ginsberg cut her teeth on Moritz v. IRS, the first of many gender-discrimination lawsuits she argued in court—a fact few Americans likely knew until the recent movie “On the Basis of Sex” was released.

The case revolved around a small tax deduction for caregiver expenses which was not available to Charles Moritz, a never married man who was the primary caregiver for his disabled mother, as the IRS did not consider the fact that a man, let alone one who wasn’t a widower, would ever be in a caregiving role.

This kind of casual sexism permeates the U.S. tax code.

The widely-used system of joint filing taxes was instituted in 1948 to incentivize women who had joined the workforce during World War II to relinquish their jobs to returning soldiers and go back to homemaking instead.

Despite the normalization of dual income households over time, modern tax policy continues to push married women at virtually every income level to work fewer hours than they otherwise would, or to stay out of the labor force entirely—a major contributing factor to the gender pay gap.

Meanwhile, those who receive sexual harassment settlements must pay income taxes on them—but the companies paying sexual harassment settlements can write them off as a “business expense.”

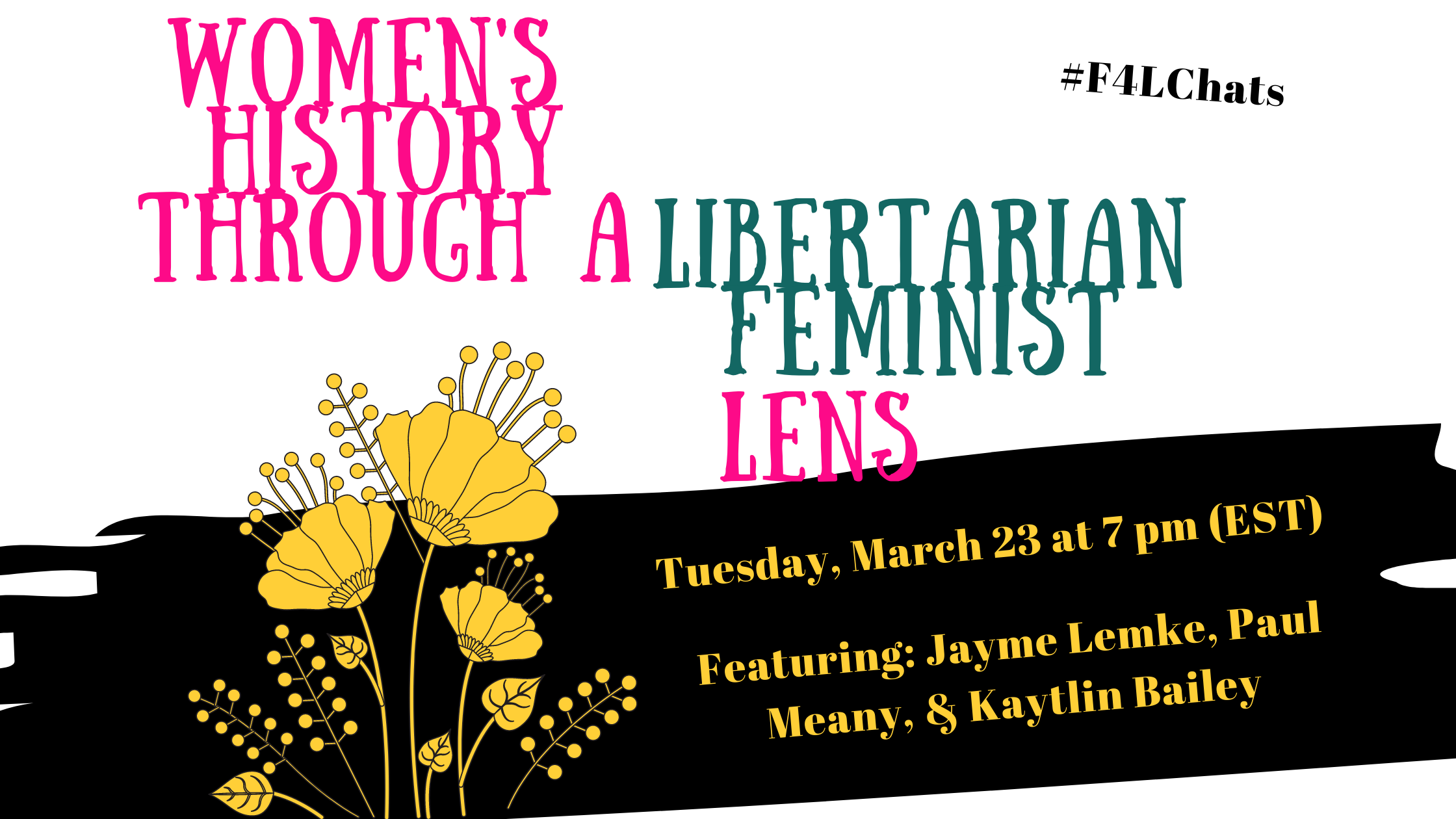

On Tuesday, May 11th, Erin Partin and Aeris Stewart joined Feminists for Liberty’s Elizabeth Nolan Brown and Kat Murti for a discussion of sexism in the tax code.

Watch the full video on YouTube and join the conversation on Twitter using #F4Lchats.